Market Review August 2025

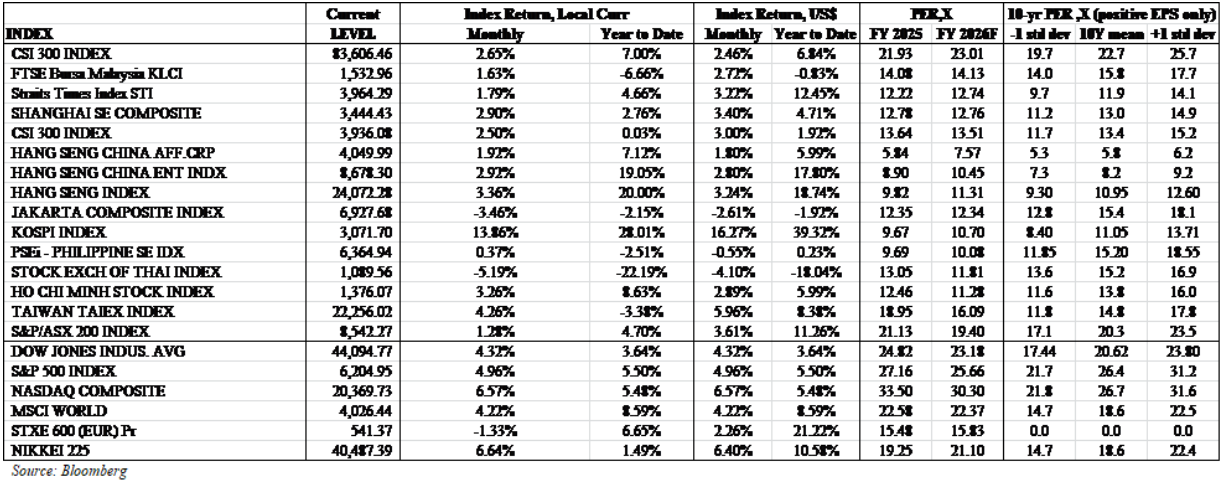

Risk asset trading volatility remained high across regions. Investor attention continued to focus on US tariffs development. The start of the corporate results announcement season saw some good numbers which brought cheers to US investors. The markets reacted positively, registering broad-based gains across risk assets. The World Index gained 1.23% in July. The MSCI Far East Ex. Japan index continued to chalk up further gain, adding 4.21%, largely due to strong performance across the various larger markets. ASEAN equities lagged with a return of +2.59%, on diverging performance among the ASEAN markets. Within ASEAN equities, Philippines and Malaysia stood out with negative returns. Thailand shares (+14.02%) and Vietnamese shares (+9.19%) were top gainers in the ASEAN region. Regional currencies mostly depreciated against the USD. The best performing currencies were Vietnamese Dong (-0.31%), Chinese Yuan (-0.50%) and Indonesia Rupiah (-1.33%), while the weaker ones were Philippines Peso (-3.41%) and Korean Won (-2.88%).

The US markets saw broad based recovery. Sentiment improved following announcements by the US on the tariffs set for its major trading partners which were above the baseline rates, but significantly lower than the rates set on “Liberation Day”. The US second quarter corporate results released so far mostly met market expectations. In the US, close to 80% of companies in the S&P 500 that have reported thus far have beaten consensus earnings and revenue growth expectations, which is better than the long-term average. Strong earnings reports reinforced the view that the political turmoil of the past months has so far had only a muted impact on US company earnings, at least for now. The information technology sector continued to outperform, but the rally extended to cyclical sectors such as industrials and consumer discretionary.

Dow Jones Industrial Average (DJIA) and S&P 500 Index and Nasdaq Composite gained 0.08%, 2.17% and 3.70% respectively. The Fed stated that economic activity has continued to expand at a solid pace although wide swings in exports have affected the data. The central bank is waiting for more clarity on the economic effect of the President’s tariffs, in particular its impact on inflation, before deciding whether to lower interest rates. The inflationary effect of tariffs is largely dependent upon where tariff rates settle.

The Stoxx Europe 600 Index gained 0.88% on profit taking. The warnings from continental technology heavyweights about the negative impact of US trade policy on 2026 growth targets prompted investors to lock in gain. Food and beverage companies also struggled, blaming increasing challenges from weak China demand.

Hong Kong and H shares indices strengthened on momentum. For the month, Hang Seng Index and Hang Seng China Enterprises Index gained 2.91% and 2.36% respectively. Chinese A shares registered positive return of 3.54%. The Chinese economy remained resilient with the second quarter GDP growth at 5.2% Year-on-year. Other economic indicators also showed stable economic activities. The industrial production was better than expectations, rising 6.8% Year-on-year in June. The Caixin manufacturing output purchasing managers’ index (PMI) moved above the 50-point threshold, denoting expanding activity, although new export orders fell.

South Korea’s KOSPI Index continued to gain, adding 5.66%. The 2nd supplementary budget launched in July further boosted sentiment. The budget projected W21.5tn of tax revenue, with expenditure of W17.3tn to stimulate consumption and investment, and W5.3tn towards social stability measures. South Korea’s annual rate of inflation picked up pace last month. Consumer price inflation rose to 2.2% in June, fueled by rising costs of industrial goods and processed food, according to official data from Statistics Korea. This marks the sharpest year-on-year increase since January due to weakening of the Korean won, which has increased the cost of imported industrial goods.

Taiwan’s TWSE Index made a gain of 5.78%, boosted by global technology sector strength. Taiwan export orders totalled US$56.77bn in June, down 2.0% Month-on-Month and up 24.6% Year-on-year, beating consensus of 23.2% Year-on-year growth. Electronics orders were mostly down Month-on-Month but up Year-on-year, indicating that order front-loading has reached its peak, while orders for raw materials were sluggish. Taiwan’s consumer confidence index (CCI) edged up by 0.68 points in July to 64.38, marking its first increase after nine months of steady decline, a survey by National Central University showed. The rebound was mainly fueled by a sharp 5.15-point rise in sentiment towards stock investment.

Singapore’s STI gained 5.28% on government initiatives to strengthen the capital market. Singapore’s central bank allocated SGD 1.1 billion to three asset managers as part of its SGD 5 billion Equity Market Development Programme (EQDP) aimed at strengthening the local stock market. The move follows a broader review by the Monetary Authority of Singapore (MAS) launched in August 2023 to improve market structure and functioning.

Malaysia’s KLCI declined 1.29% on weaker economy growth outlook. Malaysia’s economy is forecast to grow by 4.5% in the second quarter of 2025 based on advance gross domestic product (GDP) estimates, slightly outpacing previous quarter’s 4.4%. Growth is expected to be driven by robust domestic demand amid global headwinds, according to the Statistics Department Malaysia.

Thailand’s SET Index recovered strongly, gaining 14.02% on bargain hunting. The cease-fire agreement reached between Thailand and Cambodia to end their border conflict boosted investors’ sentiment. Thailand’s exports rose 15.5% Year-on-year to USD 28.65bn in June 2025, marking the 12th straight month of growth, albeit slower than May’s 18.4% and below the 18.7% forecast. The increase was partly due to accelerated shipments ahead of a planned 36% US tariff taking effect in August, with exports to the US surging 41.9%.

Jakarta Composite Index gained 8.04% on improved sentiment due to interest rate cut. The Bank of Indonesia lowered the rate 25 bps to 5.25%. Indonesia consumer confidence increased slightly to 117.8 in June vs 117.5. Indonesia retail sales grew 1.9% Year-on-year in May, which rebounded from the 0.3% decline in April. The recovery came from sales of food, beverages and tobacco (4% vs 1.2% in April), and cultural and recreational goods (4.7% vs 3.6%), while sales fell lesser for household appliances (-5.8% vs -10.5%) but sales decline for information and communication equipment deepened (-27.4% vs -5.1%). Car sales slumped 22.6% Year-on-year in June to 57.7k units, following a 15.1% drop in May.

The Philippines PSE Index declined further, losing -1.76% as weak peso hurt investors’ confidence. Trade deficit widened: Imports climbed by 10.8% year-on-year to USD 11 billion in June 2025, rebounding from a downwardly revised 1.1% fall in the previous month. This marked the highest inbound shipments since March.

Vietnam’s VN-Index continued to strengthen, gaining 9.19%. Vietnam’s GDP expanded 7.96% Year-on-year in Q2 2025, accelerating from a 6.93% rise in Q1 and marking the fastest pace since Q3 2022, according to flash estimates. The latest result reflected solid progress toward the growth target of at least 8%. All sectors posted stronger increases, including services (8.46% vs 7.70% in Q1), industry and construction (8.97% vs 7.42%), and agriculture (3.89% vs 3.74%). Trade remained resilient despite global headwinds and rising U.S. tariffs, with exports and imports up by 18% and 18.8% Year-on-year, respectively. Vietnam was one of the first countries to secure a bilateral trade agreement with US that set the US tariff at 20%, down from the previously set rate of 46%.

Market optimism over the election of Donald Trump as the new US President on expectations that his policies would be positive for the US had sparked a recalibration of macro variables and asset allocation decision. However, the US Administration’s subsequent tariff announcements and the inconsistent and frequent policy changes made in their wake have led to heightened market gyrations and volatility. Following the broad sell off after the announcement of across-the-board reciprocal tariffs on “Liberation Day”, the markets have recovered much of their losses when Trump turned down the heat for most countries, at least for the time being, on April 9, and then on May 12 when US and China agreed on a framework to reduce substantially the tariffs that they had slapped on each other. With the finalization of tariff rates with majority of US’ trading partners, trade matters are heading into tailwind, at least for now. As for the US tariff for China, the US and China teams held the third round of bilateral meeting in Stockholm in late July. There was no announcement of any agreement, but both sides signalled willingness to continue negotiations. It remains a matter of conjecture as to whether the tariff dusts have really settled, as there appears to be a propensity for issues to burst to the surface that could change what has been agreed. Moreover, tied to the so called tariff agreements are commitments on investments and spendings to be made by the trading partner, and it is uncertain how these would pan out. In the light of the higher tariffs on imports into the US, economic forecast may have factored in slower global trade going forward, but actual impact may potentially result in disappointment.

During his Presidential election campaign, Donald Trump had also pitched to bring about a quick end to the Russia-Ukraine war should he be elected. Since his inauguration as US President, Trump has made moves in seeking to bring about a cessation of the conflict in Ukraine. An end to the Ukraine conflict would be positive for the equity markets. However, a peaceful resolution of the conflict does not appear to any nearer. It remains to be seen if Trump and his Administration will succeed in orchestrating a cessation of the conflict in Ukraine. If this does come about, it would change the geo-political situation in Europe and elsewhere. Meanwhile, the Middle East remains a hot spot given the tense situation between Iran and Israeli, and Israel’s continuing military actions in Gaza. The geopolitical headwinds remain.

We are watchful of geo-political developments as well as policy directions in the major economies, in particular US under a Trump Administration and in China. The market is keenly watching where Trump’s tariffs for the key trade partners will settle. The market is also attentive to other US policy pronouncements that would have major fiscal, financial and economic implications. Investors, by and large, appear to be comfortable with Trump’s “Bill Beautiful Bill” that has been signed into law, notwithstanding that it will substantially increase US federal deficit and government debt.

In Asia, the focus is on the pace of China’s economic recovery which has been weaker than expected. The tariff issues with the US can only exacerbate the economic situation. The Chinese property sector continues to face severe challenges, and any sign of stabilization and growth will have positive catalyst for China’s economy and risk assets. The Chinese government continues to bring forth various measures to help the economy. In September 2024, the Chinese government announced a slew of monetary, fiscal and policy measures to stimulate investment and consumption, enhance liquidity and restore confidence in the property and financial markets. Since then, there were additional measures taken. The Chinese government remains constructive on policies to spur economic activities to achieve economic growth target. The various measures have boosted market sentiments. However, the longer-term effectiveness remains to be seen and will be closely watched. It may take time for the initiative to bear fruits. The focus will be on addressing the challenges in the property market, lifting consumer sentiments and consumption, and countering the effects of the new US tariffs.

On external trade, countries with high export dependency for growth in the Asia region including ASEAN will face significant challenges arising from the US tariff policies, even at the agreed rates that are significantly below the levels announced by the US during the “Liberation Day”. The disruption in supply chain realignment may result in temporary mismatch in corporate earnings delivery against market expectation during the initial stage of tariff implementation. This can result in further trading volatility for risk assets. Longer-term, higher tariffs may result in corporate margin erosion and slower earnings growth outlook. Consumers may have to pay higher prices, and this translates to higher inflation rate.

While interest rates have started to be eased, there remains headwind for risk assets, including the impact of the still high interest rate on business and economic activities, uncertainties in the US policies post the US Presidential election, the still historically high market valuations in the US, the continuing geo-political tension in Europe, Middle East and in East Asia, and the still slower than expected economic growth in China. However, in the investment space we are in, we believe there is room for cautious optimism. After years of prolonged sell down, China equities are under-owned and their favourable valuation offer potential upside, particularly following the recent rounds of significant policy change initiatives from China.

We continue to apply our strategy of focusing on identifying fundamentally healthy companies with low valuations, low leverage, high growth, robust management and a strong track record, and adherence to our investment philosophy of “Never Fully Invest at All Times” which has served us well over the years.

We thank you once again for your continued faith in us, and hope to remain good stewards in our endeavour to protect and grow your capital.

This article is solely for information purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, investment product or service. The information contained herein does not have any regard to the specific investment objectives, financial situation or particular needs of any person. Investors may wish to seek advice from a financial advisor before making any investment decision. Past performance is not indicative of future results. An investment is subject to investment risks, including the possible loss of the principal amount invested.