Market Review July 2025

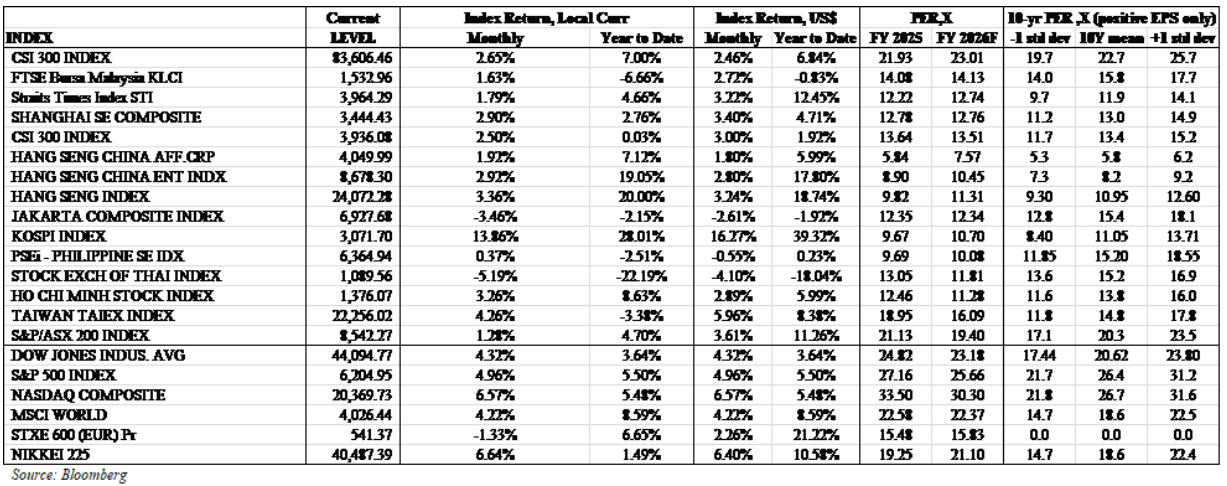

Risk asset trading volatility remained high across regions, brought about by escalation in Israeli-Iranian conflict. Israel launched pre-emptive aerial bombardments of Iranian nuclear sites, and it was soon met with retaliatory strikes by Iran in Israeli cities. The situation took an ominous turn when the US joined in the fray by sending bombers to release deep-ground penetrating bombs at Iranian sites aiming to demolish Iran’s uranium-enrichment facilities. Paradoxically, Trump called for a ceasefire between Israel and Iran following the US bombing mission, and both sides agreed to a tentative ceasefire after 12 days of hostilities. The markets reacted positively, registering broad-based gains across risk assets. The World Index gained 4.22% in June. The MSCI Far East Ex. Japan index chalked up further gain, adding 6.36%, largely due to strong performance of Korea (+13.86%) and Taiwan markets (+4.26%) on the back of strong appreciation of the Taiwan Dollar and Korea Won against the USD. ASEAN equities lagged on relatively basis with a return of -0.07% on strong divergence in performance across the ASEAN markets. Within ASEAN equities, Singapore, Vietnam and Malaysia stood out with positive returns. The laggards were Thailand shares (-5.19%) and Indonesia shares (-3.46%). Regional currencies mostly appreciated against the USD. The best performing currencies were Taiwan NT (+2.21%), Korea Won (+2.11%) and Singapore Dollar (+1.52%), while the weaker ones were Philippines Peso (-1.02%) and Vietnamese Dong (-0.37%).

Risk asset trading volatility remained high across regions, brought about by escalation in Israeli-Iranian conflict. Israel launched pre-emptive aerial bombardments of Iranian nuclear sites, and it was soon met with retaliatory strikes by Iran in Israeli cities. The situation took an ominous turn when the US joined in the fray by sending bombers to release deep-ground penetrating bombs at Iranian sites aiming to demolish Iran’s uranium-enrichment facilities. Paradoxically, Trump called for a ceasefire between Israel and Iran following the US bombing mission, and both sides agreed to a tentative ceasefire after 12 days of hostilities. The markets reacted positively, registering broad-based gains across risk assets. The World Index gained 4.22% in June. The MSCI Far East Ex. Japan index chalked up further gain, adding 6.36%, largely due to strong performance of Korea (+13.86%) and Taiwan markets (+4.26%) on the back of strong appreciation of the Taiwan Dollar and Korea Won against the USD. ASEAN equities lagged on relatively basis with a return of -0.07% on strong divergence in performance across the ASEAN markets. Within ASEAN equities, Singapore, Vietnam and Malaysia stood out with positive returns. The laggards were Thailand shares (-5.19%) and Indonesia shares (-3.46%). Regional currencies mostly appreciated against the USD. The best performing currencies were Taiwan NT (+2.21%), Korea Won (+2.11%) and Singapore Dollar (+1.52%), while the weaker ones were Philippines Peso (-1.02%) and Vietnamese Dong (-0.37%).

The US markets saw broad based recovery. Sentiment improved following US-China framework agreement to reduce US tariff on Chinese imports from 145% to 30%, and reduction of Chinese levies on U.S. goods from 125% to 10%. The agreement was for a period of 90 days. The strong market performance was also underpinned by resilient economic data as indicated by steady US job growth and declining inflation. The information technology sector continued to outperform, but the rally extended to cyclical sectors such as industrials and consumer discretionary. However, policy uncertainty weighed on healthcare sector. Dow Jones Industrial Average (DJIA) and S&P 500 Index and Nasdaq Composite gained 4.32%, 4.96% and 6.57% respectively. The new job growth exceeded expectation. There were 177k jobs created in April, above the forecast (+133k), and the 12-month average (+152k). The unemployment rate was steady at 4.2%. A strong labour market could be the key to the U.S. avoiding an economic recession. A steady decline in new jobs or a rise in weekly jobless claims could be cause for concern.

The Stoxx Europe 600 Index down 1.33%. The continued flow of global funds into the region on allocation decision amid dollar weakness against euro supported the index strength. The earnings forecasts for European companies are nudging higher. A higher dividend yield of more than 3% is twice that paid by US companies. European companies return 5% of their value to shareholders through dividends and share buybacks this year versus 4% for US companies. This has attracted investors’ interest into the region.

Hong Kong and H shares indices strengthened on momentum. For the month, Hang Seng Index and Hang Seng China Enterprises Index gained 3.36% and 2.92% respectively. Chinese A shares registered positive return of 2.50%. Economic activities data were mixed with services sector faring better than manufacturing. China’s services activity expanded at a faster pace in May. The Caixin China services purchasing managers’ index rose to 51.1 from 50.7 the month before, according to a statement from Caixin and S&P Global. China’s manufacturing sector had its worst slump since September 2022. The Caixin manufacturing purchasing managers’ index fell to 48.3 in May from 50.4 in the prior month, according to a statement released by Caixin and S&P Global, well below the 50-mark separating expansion from contraction.

South Korea’s KOSPI Index surged 13.86% on proactive economic measures introduced by the new government, although economic indicators continued to be muted. The South Korean government announced its second supplementary budget for 2025, amounting to KRW 30.5tn, significantly larger than the first supplementary budget of KRW 12.2tn introduced in April. The new budget includes KRW 15.2tn to boost consumption and investment, KRW 5tn for support to SMEs and vulnerable groups, and KRW 10.3tn to offset the shortfall in tax revenues. The centrepiece of the stimulus is a universal cash handout program, offering KRW 150,000–500,000 in vouchers per citizen, totalling KRW 10.3tn. The fresh fiscal injection totals KRW 20.2tn (0.8% of GDP). The composite business sentiment index in all industries in South Korea decreased 0.5 points to 90.2 in June from the previous month.

Taiwan’s TWSE Index made a gain of 4.26%, boosted by global technology sector strength. Taiwan’s central bank (CBC) kept the policy rate, reserve requirement ratio, and credit controls unchanged. The CBC refrained from providing clear signals on potential rate cuts in the second half of the year, citing significant uncertainties related to US tariff policies. Taiwan’s industrial output surged over 22% in May from a year earlier, buoyed by booming tech demand and a rush by foreign buyers to beat looming U.S. tariffs- marking 15 consecutive months of growth according to the Ministry of Economic Affairs (MOEA). Taiwan’s unemployment rate in May was 3.30%, little changed from a year earlier, but still plumbing 25-year lows, reported the Directorate-General of Budget, Accounting and Statistics (DGBAS).

Singapore’s STI gained 1.79%. Singapore’s non-oil domestic exports (NODX) unexpectedly slumped 3.5% Year-on-Year in May 2025, reversing a 12.4% jump in April and missing expectations of an 8.0% rise. This marked the first decline in non-oil domestic exports since January and the strongest contraction in seven months. Monthly, NODX plunged 12.0%, the steepest decline since May 2023, reversing a 10.4% surge in April, which was the fastest pace in five months.

Malaysia’s KLCI recovered, gaining 1.63%. Malaysia’s Producer Price Index (PPI) declined by 3.6% in May 2025, marking a steeper drop compared to April’s 3.4% decrease, according to the Department of Statistics Malaysia (DOSM). All sectors recorded year-on-year declines except agriculture, forestry, and fishing. The mining sector continued its double-digit slump, falling 15%, driven by sharp drops in crude petroleum (15.7%) and natural gas extraction (13.1%).

Thailand’s SET Index declined further with a 5.19% drop on political uncertainty and weak economic activities. Thailand’s economy grew by 0.7% Quarter-on-Quarter in Q1 2025, slightly above expectations and faster than Q4 2024’s 0.4% growth. Exports rose 2.0%, especially to the US ahead of new tariffs, while imports fell by 2.4% due to weak domestic demand. However, government spending and fixed investment declined further. On a year-on-year basis, GDP rose 3.1% in Q1 2025, beating forecasts but easing from 3.3% in Q4 2024.

Jakarta Composite Index declined 3.46% on profit taking. Bank Indonesia (BI) held its policy rate unchanged at 5.5% during its June policy meeting, following a 25bps cut in May. Loan growth continued to ease to 8.43% in May 2025, down from 8.88% in April. BI urges lower lending rates to support loan growth. For the first five months, State revenue declined more than expenditure, resulting in higher deficit. Revenue was Rp995 trillion (-11% Year-on-Year, 33% FY2025 budget). Meanwhile, expenditure was Rp1,016 (-11% Year-on-Year, 28% of FY2025 budget).

The Philippines PSE Index gained 0.37%. The Central Bank of the Philippines lowered its benchmark interest rate by 25 bps to 5.25% during its June 2025 policy meeting, marking the lowest rate in two and a half years and in line with market expectations. The decision reflects a more moderate inflation outlook and the need to support growth with a more accommodative stance. The annual inflation rate edged down to 1.3% in May 2025 from 1.4% in the previous month, matching market forecasts and marking the lowest level since November 2019.

Vietnam’s VN-Index continued to strengthen, gaining 3.26%. Vietnam expects positive results from trade negotiations with the US will come sooner than the US tariff deadline, according to Prime Minister Pham Minh Chinh. Meanwhile, the government is rolling out a range of initiatives, including infrastructure projects, energy transition, trade diversification and promotion of domestic consumption, to boost economic activities. The Government proposed the National Assembly to allow private sector participation in the North-South High-Speed Railway project. This change signals a shift towards opening national projects to corporate investment following the issuance of Resolution 68 on private sector development.

Market optimism over the election of Donald Trump as the new US President on expectations that his policies would be positive for the US had sparked a recalibration of macro variables and asset allocation decision. However, as a result of concern about the potential impact of his broad ranging and stiffer than expected tariff policies announced on April 2, market expectation turned negative and US inflation and interest rate outlook turned less dovish. The tariff announcements and the inconsistent and frequent policy changes made in their wake have led to heightened market gyrations and volatility. Following the broad sell off after the announcement of across-the-board reciprocal tariffs on “Liberation Day”, the markets have recovered much of their losses when Trump turned down the heat for most countries, at least for the time being, on April 9, and then on May 12 when US and China agreed on a framework to reduce substantially the tariffs that they had slapped on each other. However, uncertainties remained. It remains a matter of conjecture as to where the tariffs will eventually settle. Trump is expected to announce what will be the tariffs that will apply to the various countries as we approach the July 9 deadline. Markets could be roiled along the way, although it appears that investors are relatively sanguine about what may come. However, should the outcome turned out to be way out of expectation, the economies and markets will be materially impacted. Economist forecast may have factored in slower global trade going forward, but actual impact may potentially result in disappointment.

During his Presidential election campaign, Donald Trump had also pitched to bring about a quick cessation to the Russia-Ukraine war should he be elected. Since his inauguration as US President, Trump has made moves in seeking to bring about a cessation of the conflict in Ukraine. An end to the Ukraine conflict would be positive for the equity markets. However, a peaceful resolution of the conflict does not appear to any nearer. It remains to be seen if Trump and his Administration will succeed in orchestrating a cessation of the conflict in Ukraine. If this does come about, it would change the geo-political situation in Europe and elsewhere. Meanwhile, the recent flare up of the conflict between Iran and Israeli, with limited participation by the US, added to geopolitical risk premium. Although a cease fire was temporarily brokered, and appears to be holding, the geopolitical headwinds remain.

We are watchful of geo-political developments as well as policy directions in the major economies, in particular US under a Trump Administration and in China. The market is keenly watching where Trump’s tariffs for the key trade partners will settle. The market is also attentive to other US policy pronouncements that would have major fiscal, financial and economic implications. Investors, by and large, appear to be comfortable with Trump’s “Bill Beautiful Bill” that is winding its way through the the US legislature, notwithstanding that it will substantially increase US federal deficit and government debt. Trump has set July 4 as the deadline for passing the Bill.

In Asia, the focus is on the pace of China’s economic recovery which has been weaker than expected. The tariff issues with the US can only exacerbate the economic situation. The Chinese property sector continues to face severe challenges, and any sign of stabilization and growth will have positive catalyst for China’s economy and risk assets. The Chinese government continues to bring forth various measures to help the economy. In September 2024, the Chinese government announced a slew of monetary, fiscal and policy measures to stimulate investment and consumption, enhance liquidity and restore confidence in the property and financial markets. Since then, there were additional measures taken. The Chinese government remains constructive on policies to spur economic activities to achieve economic growth target. The various measures have boosted market sentiments. However, the longer- term effectiveness remains to be seen and will be closely watched. It may take time for the initiative to bear fruits. The focus will be on addressing the challenges in the property market, lifting consumer sentiments, and countering the effects of the new US tariffs.

On external trade, countries with high export dependency for growth in the Asia region including ASEAN will face significant challenges arising from the US tariff policies, particularly if the tariffs remain at the levels announced by the US during the “Liberation Day”. The disruption in supply chain realignment may result in temporary mismatch in corporate earnings delivery against market expectation during the initial stage of tariff implementation. This can result in further trading volatility for risk assets. Longer-term, higher tariffs may result in corporate margin erosion and slower earnings growth outlook. Consumers may have to pay higher prices, and this translates to higher inflation rate.

While interest rates have started to be eased, there remains headwind for risk assets, including the impact of the still high interest rate on business and economic activities, uncertainties in the US policies post the US Presidential election, the still historically high market valuations in the US, the continuing geo-political tension in Europe, Middle East and in East Asia, and the still slower than expected economic growth in China. However, in the investment space we are in, we believe there is room for cautious optimism. After years of prolonged sell down, China equities are under-owned and their favourable valuation offer potential upside, particularly following the recent rounds of significant policy change initiatives from China.

We continue to apply our strategy of focusing on identifying fundamentally healthy companies with low valuations, low leverage, high growth, robust management and a strong track record, and adherence to our investment philosophy of “Never Fully Invest at All Times” which has served us well over the years.

We thank you once again for your continued faith in us, and hope to remain good stewards in our endeavour to protect and grow your capital.

This article is solely for information purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, investment product or service. The information contained herein does not have any regard to the specific investment objectives, financial situation or particular needs of any person. Investors may wish to seek advice from a financial advisor before making any investment decision. Past performance is not indicative of future results. An investment is subject to investment risks, including the possible loss of the principal amount invested.